The auto ancillary stock market presents a intriguing landscape for investors seeking to benefit from the get more info growth of the automotive industry. This sector encompasses a wide range of companies that manufacture components and services essential for vehicle production. Comprehending the nuances of this market is crucial for success.

A key consideration is the volatility inherent in the auto industry. Demand for ancillary products depends on overall vehicle sales, which can be shaped by economic conditions and consumer confidence.

Investors should carefully analyze industry trends, financial reports to assess the likelihood of future growth.

It is also essential to perform in-depth research on individual companies, including their operating margins, management team, and industry positioning.

Prominent Indian Auto Ancillary Companies to Watch in 2024

The Indian auto ancillary industry expects for a period of significant growth in 2024. Driven by increasing domestic demand and a surge in electric vehicle (EV) adoption, several companies are ready to excel. Here's a look at some of the leading players to monitor:

* **Mahindra Ssangyong Motor India:** With its focus on SUV development, Mahindra continues to innovate.

* **Bosch Limited:** A global manufacturing powerhouse, Bosch's presence in India is expanding rapidly.

* **Tata AutoComp Systems:** This integrated supplier offers a range of components across various vehicle segments.

* **Sundaram Clayton Limited:** Known for its strength in castings, Sundaram Clayton will likely thrive in the evolving automotive landscape.

Unveiling the Potential of Auto Component Stocks

Auto component stocks present a compelling avenue for investors seeking exposure. The automotive industry is undergoing a period of evolution, driven by trends such as connectivity. This shift creates demand for advanced components, supporting the growth of auto component manufacturers. Moreover, government policies are encouraging adoption of electric vehicles and autonomous driving technology, even more boosting the demand for specialized components.

A informed investment approach can capitalize this potential. It is crucial to conduct thorough analysis and choose companies with solid financial standing, a proven track record of innovation, and exposure in expanding segments of the automotive market.

Delving into India's Thriving Automotive Industry: A Complete Guide to Auto Manufacturers

India's automotive sector is a dynamic and rapidly evolving field. Prominent global automakers, alongside a dynamic domestic manufacturing base, contribute to this robust ecosystem. From commercial vehicles to electric automobiles, India's automotive landscape offers ample opportunities for enthusiasts. A detailed list of auto companies operating in India can provide valuable insights into this faceted sector.

- Tata Motors

- Toyota Kirloskar Motor

- Volkswagen Group India

Ancillary Sector Stocks: Riding the Wave of Growth in the Indian Automotive Industry

The Indian automotive industry is experiencing a period of robust growth. This surge is propelling demand for auto ancillary products, creating lucrative opportunities for companies operating in this sector. Financial analysts are monitoring these stocks closely as they present a promising avenue for gains.

Several factors are driving the growth of the auto ancillary market in India. The increasing disposable incomes of consumers, coupled with urbanization and infrastructure development, have led to a surge in vehicle sales. This translates into increased demand for auto parts and components.

Furthermore, the government's initiatives aimed at promoting manufacturing in India are enhancing the growth of the automotive sector. These policies have enticed both domestic and foreign investment, leading to the development of new auto ancillary units.

The future outlook for auto ancillary stocks in India remains positive. The continued expansion of the automotive industry is expected to fuel demand for these products, creating a favorable investment landscape.

Performance Analysis of Leading Auto Component Stocks in India

The Indian auto component industry has witnessed substantial growth in recent years, driven by a booming domestic automotive market and increasing needs for components globally.

Traders are closely monitoring the performance of leading auto component stocks to capitalize on this positive market situation. A comprehensive assessment of these stocks, considering factors such as revenue growth, is crucial for strategic investment.

Key metrics to analyze include income generation, profitability ratios, and investment yield. Furthermore, it is important to analyze the industry dynamics and the effect of external factors such as government policies, technological advancements, and macroeconomic factors.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Hallie Eisenberg Then & Now!

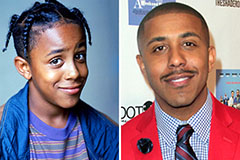

Hallie Eisenberg Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!